Investors have always embraced the risk of long-term bonds, lured by the promise of higher returns—otherwise known as term premiums—over short-term bonds or cash. But what happens when that extra reward starts to fizzle out? Suddenly, holding onto long-duration bonds feels a lot less attractive, and investors are left rethinking their game plan.

It seems the bond market is at a crossroads. The once-reliable advantage of long term bonds over cash — the backbone of fixed-income investing — is slipping away. This shake-up has turned conventional wisdom on its head, leaving investors scrambling to rework their strategies. So, what’s really going on, and what does it mean for your portfolio? Let’s investigate this phenomenon and its implications.

1. Historical Perspective: U.S. Excess Bond Returns

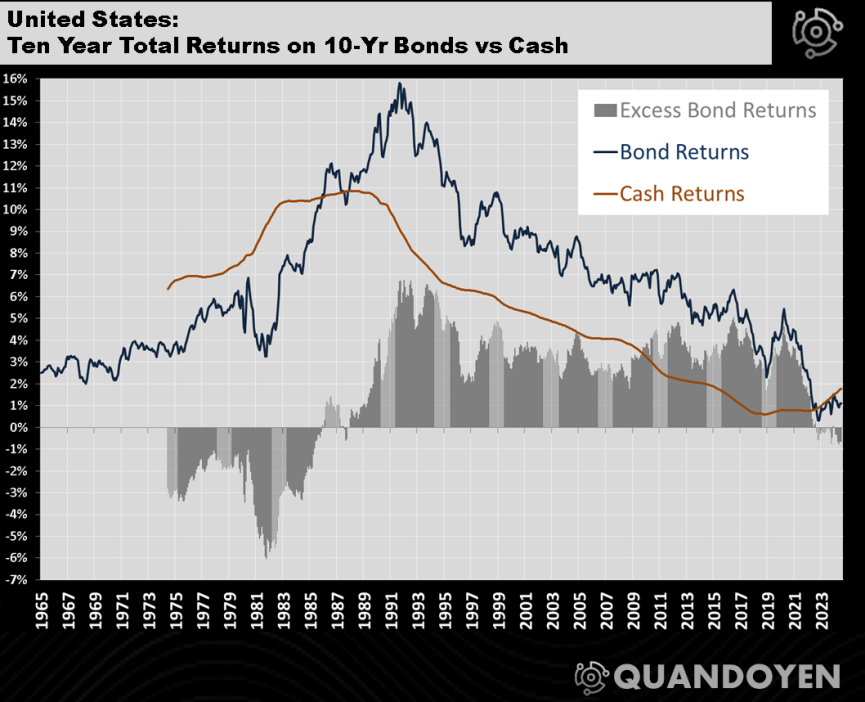

To understand our current predicament, we must first look back. This graph illustrates the relationship between sovereign ten-year bond returns, cash returns, and excess bond returns in the United States from the 1950s through 2023.

- Inflationary Rollercoaster (Mid-1970s to Early 1980s): This wild ride was marked by sky-high bond and cash returns as the Federal Reserve fought off rampant inflation. But the sharp rise in interest rates led to negative excess bond returns, all thanks to the infamous “Volcker shock.” It was a bumpy period, with bondholders feeling the sting.

- The Great Bond Bull Run (Early 1980s to Early 2000s): After inflation cooled down, interest rates began a long, steady descent, giving birth to a golden age for bond investors. Bond returns shot up into the double digits, vastly outperforming cash, and delivering strong positive excess returns—a bondholder’s dream come true.

- Low-Yield Labyrinth (2000s to 2023): The new millennium ushered in an era of historically low interest rates, especially after the 2008 Global Financial Crisis. Bonds continued to outpace cash—at least for a while. But by 2021-2022, the tide began to turn. Central banks, in a bid to curb post-pandemic inflation, raised rates, and excess returns began to narrow, with some even dipping into negative territory.

The chart paints a clear picture of the cyclical nature of bond returns, closely tied to interest rate cycles. When rates rise, bonds tend to lag behind cash, and when rates fall, bonds tend to shine.

Now, we find ourselves at the edge of a new phase—one where bonds might consistently underperform cash. It’s a sharp departure from the decades-long bond bull market, leaving investors wondering: What’s next?

The rest of this article is available on Medium and Linkedin