In our last article, we discussed how the global bond market has been under pressure in recent years, with shrinking term premiums and diminishing excess returns leaving many investors questioning the role of long duration bonds in their portfolios. Yet, a few select markets are bucking this trend. These countries are delivering impressive bond returns, even as many global markets struggle to keep up with cash yields. What’s driving this divergence? Let’s explore the emerging stars in the bond market and what makes them stand out.

1. Global Perspective

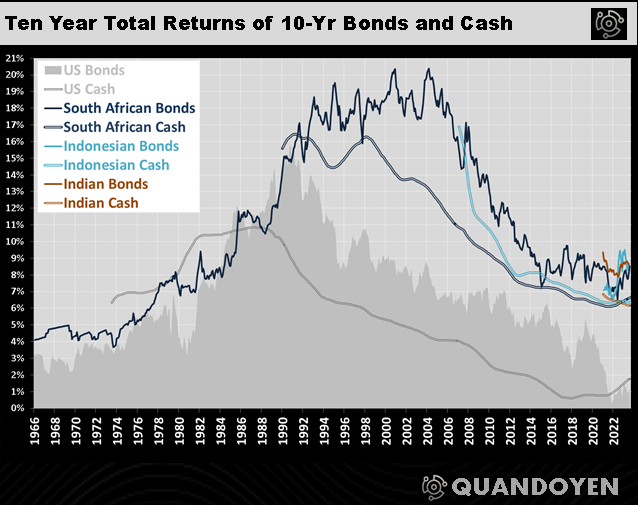

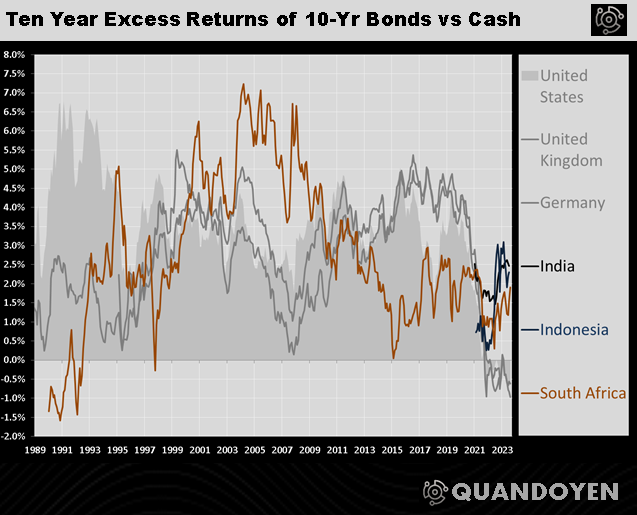

Over the past decade, bond returns have generally declined, particularly in developed markets. Ultra-low interest rates, inflation worries, and central bank interventions have all played a part. However, as developed markets faced near-zero or negative interest rates, emerging markets like South Africa, Indonesia and India have started to offer more attractive yields.

While bond returns in developed markets have remained subdued post-2020, the recovery in these emerging economies has been notable. Yield premiums continue to outpace cash yields, making them attractive for yield-seeking investors.

2. South Africa: High Risk, High Reward

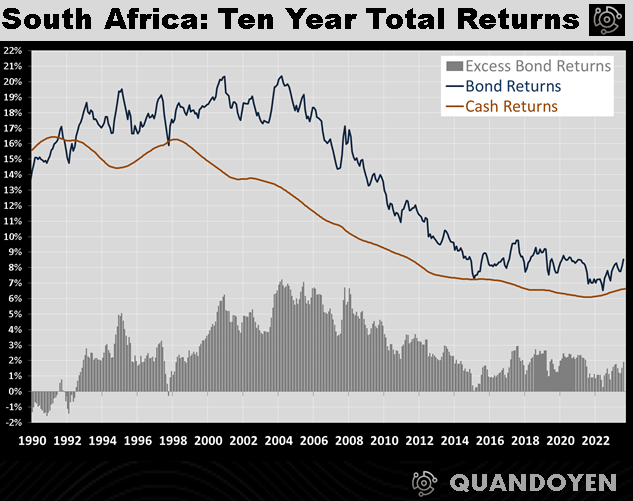

South Africa is a bond market of extremes. While it boasts some of the highest real yields in emerging markets—driven by elevated inflation and wide interest rate differentials—investors are also faced with significant uncertainties. Political turbulence, fiscal mismanagement, and challenges like Eskom’s instability, combined with sluggish economic growth, have raised concerns.

Yet, for those who can stomach the volatility, South African bonds remain a compelling option. The government’s push for fiscal consolidation and structural reforms could pave the way for improved long-term prospects. With a diverse investor base and solid local market liquidity, the country offers unique opportunities for yield-seeking investors—albeit with heightened risks.

In fact, over the past decade, South Africa’s local currency bonds have consistently outperformed cash by 1% to 2% in excess returns, showing that bondholders are still being compensated for taking on duration risk.

The rest of this article is available on Medium and Linkedin