Having dissected Novo Nordisk’s liabilities in Part 2, we’re now ready to examine another vital sign in our Merton model checkup—the risk-free rate. Think of it as the heartbeat of modern financial valuation: absolutely crucial for monitoring our patient’s credit risk.

Why is the risk-free rate such a critical vital sign? In the Merton framework, it serves as our baseline reading—like checking blood pressure in a perfectly healthy patient. It’s more than just another number in the chart; it’s the pulse that drives our entire diagnosis, from debt valuation to equity returns, right down to the probability of financial distress.

Just as every patient needs a personalized treatment plan, we need to prescribe the right risk-free rates for Novo’s unique condition. This means carefully selecting rates that match both the maturity timeline of their debt and the various currency exposures. Let’s roll up our sleeves and prepare for a thorough examination—after all, accurate diagnostics lead to actionable treatment plans!

Quick Recap of the Series

For those just joining us, here’s a summary of our journey so far:

- Part 1: ✓First Consultation Complete! We’ve taken the patient’s vital signs through our Merton model stethoscope, recording key readings like volatility and market cap.

- Part 2: ✓Initial Workup Complete! We’ve performed a thorough examination of Novo’s debt structure.

- Part 3: Currently in Treatment – We’re measuring the risk-free rate baseline readings for our bond pricing and Merton model analysis. (Think of it as calibrating our instruments!)

- Part 4: Next on our Rounds – We’ll take a deep dive into Novo’s liability values and calculate the treatment duration.

- Part 5: Final Diagnosis Ahead – We’ll gather all our lab results for a comprehensive Merton model assessment, delivering a clear prognosis based on all vital measurements.

1. A Triad of Relevant Risk-Free Rates

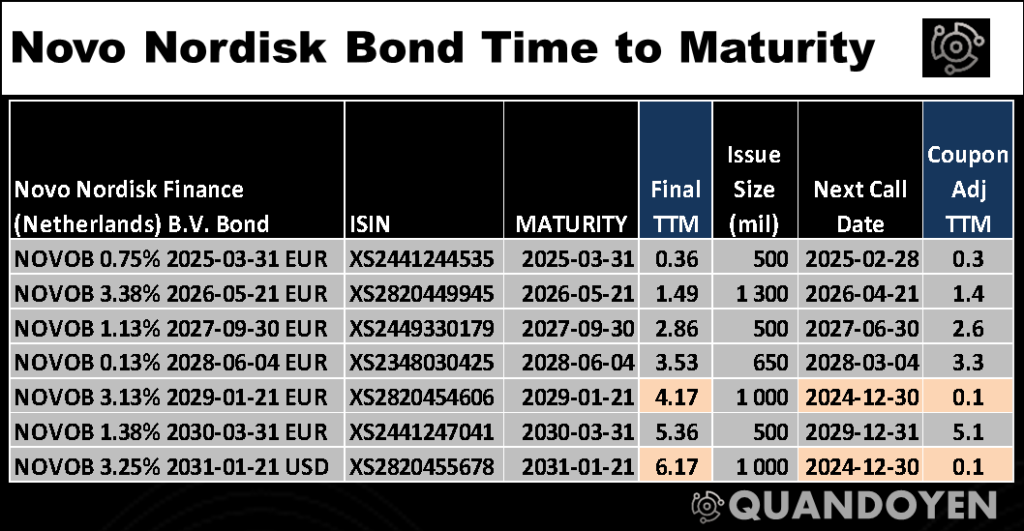

Novo Nordisk’s liabilities, as highlighted in Part 2, consist of bonds denominated in both EUR and USD. Because these bonds are issued in different currencies, we must apply the appropriate risk-free rate for each. Typically, government bond yields serve as benchmarks for these rates.

Here’s the treatment protocol we’ll follow:

- Valuation of USD Debt: We will use the US zero-coupon yield curve to discount the future cash flows (coupons and principal) of USD-denominated debt.

- Valuation of EUR Debt: We will use the EUR zero-coupon yield curve for EUR-denominated debt.

- Conversion to DKK: After valuing both debts in their respective currencies, we can convert the debt values into DKK using the prevailing exchange rates for aggregation purposes.

The rest of this article is available on Medium and Linkedin